[TheDefiant]

Yearn Finance, DeFi’s oldest yield aggregator, has revamped its tokenomics to embrace a Vote Escrow mechanism.

YFI stakers can convert their assets into non-transferable veYFI tokens by locking up their funds for between one week and ten years. Stakers receive dYFI tokens and voting power in exchange, allowing them to vote on which pools will receive the largest allocation of dYFI rewards.

“Yearn's biggest ever tokenomics revamp is finally here,” Yearn tweeted. “The veYFI flywheel introduces increased rewards and yields to veYFI holders and Vault depositors… By locking YFI to veYFI holders can vote to allocate that YFI by boosting vault rewards.”

Users who lock their assets for longer periods of up to four years get boosted rewards. Although users can exit their position before the lock-up ends, early exits incur penalties of up to 75% of rewards earned. The protocol distributes penalties among other veYFI holders.

veYFi is now the exclusive voting token for Yearn governance.

Yearn has struggled to maintain its market share as activity continues to shift to Ethereum’s Layer 2 ecosystem. High gas fees on the Ethereum mainnet during the bull run were the driving force behind the popularity of yield aggregators, which socialize transaction fees for harvesting and selling reward tokens across a pool of depositors.

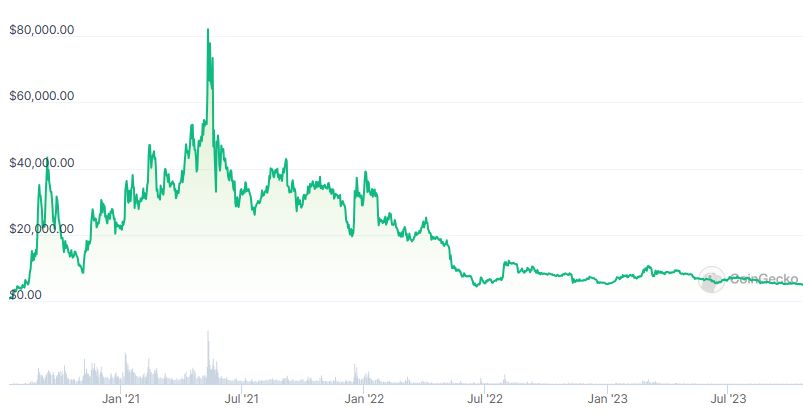

Currently trading around $5,000, YFI is down 95% from its May 2021 all-time high.

New dYFI Token

dYFI provides its holder the right to redeem their tokens for an equivalent amount of YFI in exchange for ETH at a discount compared to YFI/ETH’s market rate. Any Ether received on redemption will be used to fund Yearn’s buyback program. dYFI tokens are burned upon redemption.

Stakers locking their tokens for the minimum period receive 10% of the dYFI tokens they accrue through staking, with the remaining 90% going to other veYFI lockers. Users that lock their assets for at least four years receive 100% of dYFI farmed, while two-year locks keep 50%. However, rewards boosts decay over time.

Bi-monthly governance votes determine the allocation of rewards, with each gauge receiving different sums of bought-back YFI to emit as incentives based on how many votes they receive.

Rewards distributed through the Vote Escrow mechanism won't inflate the supply of YFI. Yearn funds dYFI redemptions with its buy-back program, which accrued roughly 1,300 YFI using past profits accumulated by the protocol.

Yearn noted that the Vote Escrow mechanism may create the risk of governance attacks, and that high demand for veYFI could impact the liquidity of YFI on exchanges.

Read the original post on The Defiant

undefined