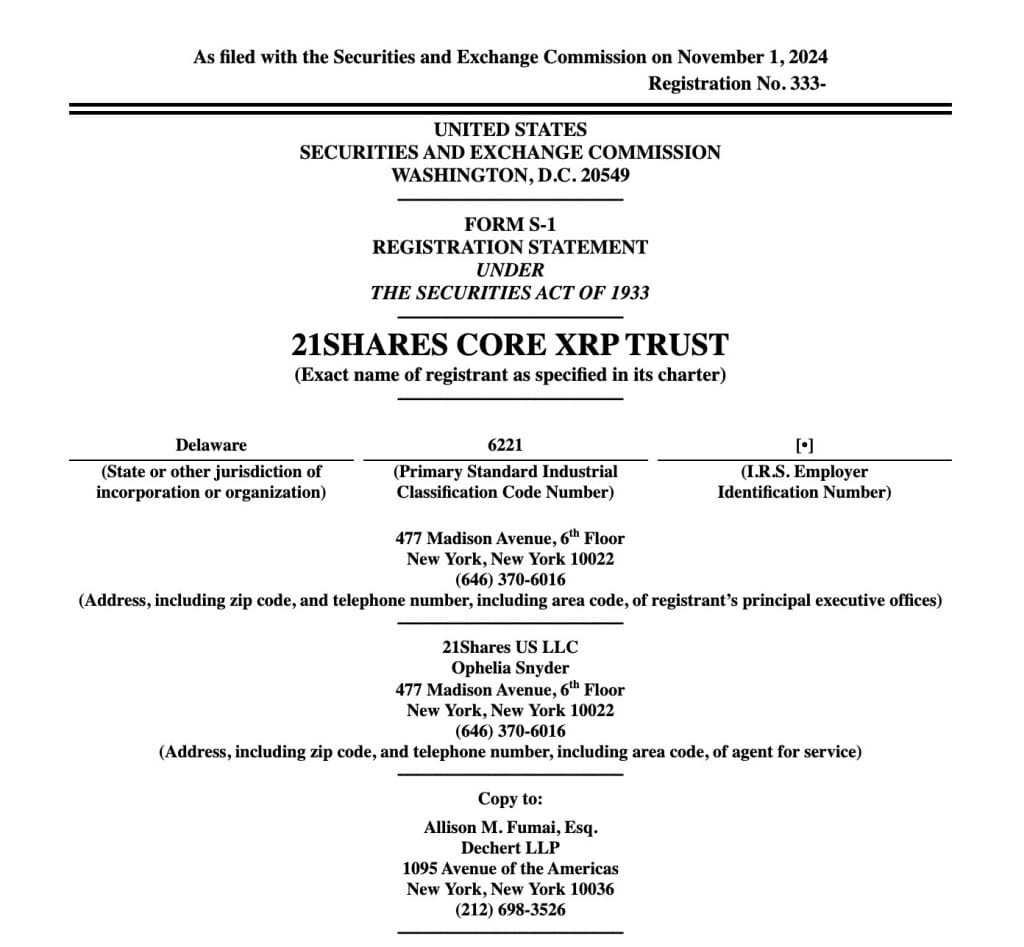

Following the path of other firms, 21Shares officially filed with the U.S. Securities and Exchange Commission (SEC) on November 1 for a U.S.-based XRP exchange-traded fund (ETF).

If approved, the new fund, named the 21Shares Core XRP Trust, will be listed on the Cboe BZX Exchange, with Coinbase Custody Trust Company as its custodian.

21Shares Files for Spot XRP ETF with SEC, Joining the Race for Crypto ETFs

The XRP ETF would allow investors to track XRP’s performance, providing a new way for institutional investors to gain exposure to the asset.

21Shares is the third company to seek SEC approval for an XRP ETF, joining Bitwise and Canary Capital.

It also follows remarks from Ripple CEO Brad Garlinghouse, who recently described an XRP ETF as “inevitable,” hinting at growing demand for such a product.

Bitcoin and Ethereum ETFs have already gained traction, setting a promising precedent for XRP. However, the path to SEC approval for an XRP ETF is challenging, given the agency’s regulatory scrutiny and long-standing legal battles with Ripple Labs, which affect XRP’s classification.

The SEC has argued that Ripple’s XRP sales were unregistered securities, while Ripple has disputed this classification.

Last year, Judge Analisa Torres of the U.S. District Court for the Southern District of New York partially ruled that certain programmatic XRP sales did not violate securities laws due to their blind bid structure. However, she also ruled that direct institutional sales were indeed securities.

XRP ETF Dreams: Will the SEC’s Resistance Hold Back the Next Crypto ETF Wave?

The SEC’s reluctance to approve XRP-related products could complicate the application process, though interest in crypto ETFs has only increased.

The application is part of a larger wave of interest from firms pursuing crypto ETFs in the U.S., especially after the SEC approved its first crypto ETFs earlier this year.

In January, the SEC approved 11 spot Bitcoin ETFs, followed shortly by eight Ethereum ETFs. Since then, firms such as VanEck and 21Shares have filed for ETFs tied to additional cryptocurrencies like Solana and Litecoin.

Following the approval of Bitcoin and Ethereum ETFs, industry analysts see the potential XRP ETF as part of the next wave of crypto-based financial products for the U.S. market.

If approved, it would be the third crypto-based ETF launched in the U.S. in 2024, expanding investment options in the evolving digital asset sector.

The post XRP ETF Hopes Rise: 21Shares Files for SEC Approval appeared first on Cryptonews.

#BlockchainNews #21Shares #SEC #XRPETF [Source: CryptoNews]