TL;DR

- Bitcoin’s 2023 Surge: Bitcoin’s price increased by 120% in 2023, leading the BTC Fear and Greed Index to show “Greed” for over 30 days, echoing late 2021 trends.

- Bullish Market Indicators: The index’s greed signal is fueled by factors like social media buzz and market momentum, driven by expectations of a US BTC ETF and the upcoming 2024 halving.

- Correction Possibility: The high greed level among investors suggests a potential market correction, while periods of fear might offer buying opportunities, aligning with Warren Buffett’s investment strategy.

Greed Reigns Among Investors

Bitcoin’s impressive comeback in 2023, especially during the second part of the year, has defied bearish forecasts and underlined the asset’s resilience to overcome each crash. The whopping 120% price increase since January 1 might be one reason why the popular BTC Fear and Greed Index has flashed “Greed” lately.

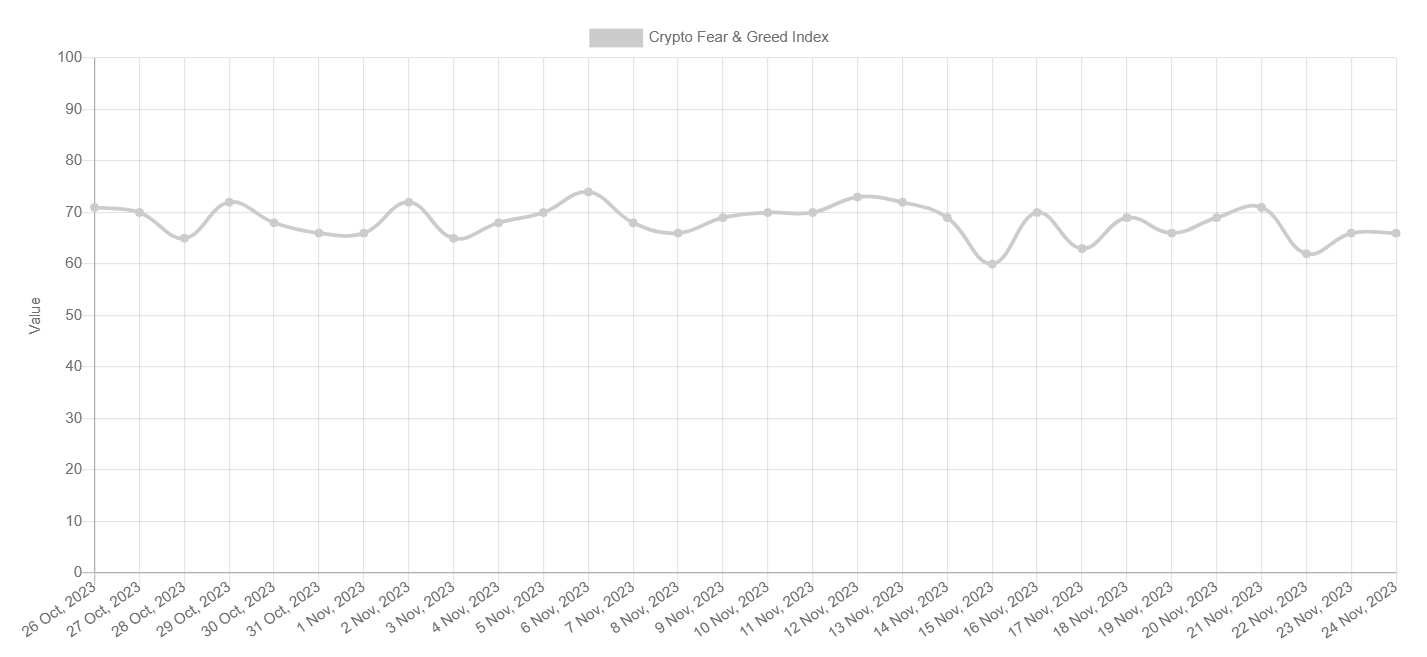

In fact, the metric has been in that territory for over 30 consecutive days, a development last observed in the final quarter of 2021 when the primary cryptocurrency hit an all-time high of almost $70,000.

The index’s result is based on numerous factors such as social media interaction, surveys, market momentum, volatility, and others. It is safe to assume that the overall condition of the cryptocurrency market has been quite bullish recently, prompted by the possible approval of a spot BTC ETF in the United States and the upcoming halving (scheduled for the spring of 2024).

Numerous experts and even the AI-powered language model ChatGPT have assumed that those elements could trigger a new all-time high for the leading digital asset next year.

Those curious to explore some price predictions coming from prominent figures could take a look at our dedicated video below:

Is BTC Correction Incoming?

The rising greed among investors, though, could also indicate that many individuals enter the market due to a FOMO (“Fear of Missing Out”) effect. In other words, when investors are getting too greedy, the market might be due for a correction.

On the other hand, it could be a good idea for people to jump on the Bitcoin bandwagon when the index points to Fear or Extreme Fear.

Such a thesis (even though not focused on cryptocurrencies) is supported by the American billionaire Warren Buffett. One of his motos states that people should be “fearful when others are greedy and to be greedy only when others are fearful.”

The post This Hasn’t Happened to Bitcoin (BTC) in Two Years appeared first on CryptoPotato.

#CryptoBits #CryptoNews #Bitcoin #Bitcoin(BTC)Price [Source: CryptoPotato]