The post Michael Saylor on Why XRP Isn’t Part of His Investment Strategy appeared first on Coinpedia Fintech News

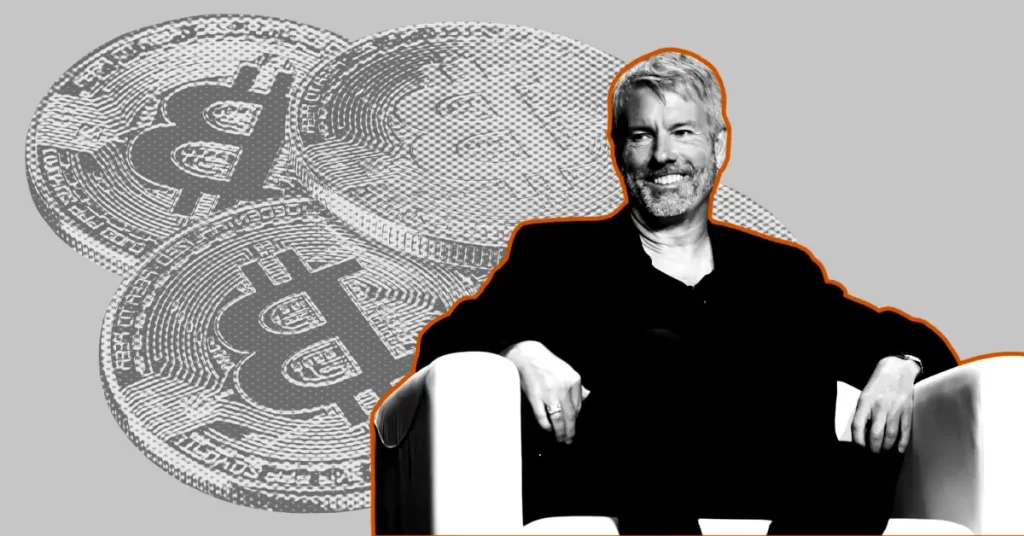

Post Trump’s win the market has turned bullish, Bitcoin is trading at $92,460, up 1% in the last day, edging closer to a $2 trillion market capitalization as its price continues to rise. While XRP has crossed its long-stagnant position of $1 with a 50% rally, Michael Saylor, the chairman of MicroStrategy and a prominent Bitcoin advocate, has rebuffed the claims that he will not recommend assets like XRP to clients.

Speaking on the PBD Podcast, Saylor made it clear that he remains exclusively focused on Bitcoin, viewing it as the ultimate long-term investment. Highlighting the risks associated with securities, he noted his avoidance of assets with counterparty risks, including cryptocurrencies like XRP and even well-known stocks like Apple.

XRP Over Bitcoin, No Chance Says Saylor!

MicroStrategy’s stock has surged 2,735% in the past five years, thanks to its decision to invest in Bitcoin, making it a leader in corporate Bitcoin holdings. Saylor emphasized his perspective of Bitcoin as “digital capital” and the most reliable asset in the volatile crypto market. Despite a U.S. court ruling last July that XRP isn’t a security, Saylor’s comments suggest he still views it as such.

While his investment philosophy centers on Bitcoin, Saylor expressed optimism about the broader digital asset ecosystem. He further said that tech giants like Microsoft, Apple, and Google are missing out by not investing in Bitcoin. Despite holding $78 billion in cash reserves and backing projects like Skype and OpenAI, Microsoft hasn’t ventured into Bitcoin or related assets. Saylor argues Bitcoin is a superior alternative to cash reserves, suggesting that if Apple invested $100 billion in Bitcoin, it could grow to $500 billion, creating a business with 20% annual growth.

Under Saylor’s leadership, MicroStrategy has embraced Bitcoin as a treasury strategy, holding over 330,000 BTC worth $30 billion. He credits this move for helping MicroStrategy outperform broader markets, urging other companies to adopt a similar approach.

Take on Stablecoins

On stablecoins like USDT and USDC, Saylor acknowledged their growing importance, particularly in economically unstable regions like Venezuela and Cuba. He noted their potential to modernize global finance and address humanitarian challenges. However, he highlighted the need for clear regulatory frameworks in the U.S. to enable stablecoins to grow from $150 billion to possibly $10 trillion in the future.

What’s Next for XRP?

Despite the negativity, On-chain data reveals a growing demand for XRP, with significant withdrawals from major exchanges. Over the past week, 250 million XRP tokens were withdrawn from Upbit, bringing its reserves to a four-month low of 6.3 billion tokens, according to CryptoQuant. Similarly, Binance has seen a steady decline in XRP reserves since November 12.

This drop in exchange reserves indicates increased buying pressure, as investors transfer XRP to private wallets, often signifying long-term holding strategies. With reduced supply on exchanges, XRP’s price may see upward momentum, pointing to a potentially bullish trend ahead.

#News #Ripple(XRP) [Source: Coinpedia]