[TheDefiant]

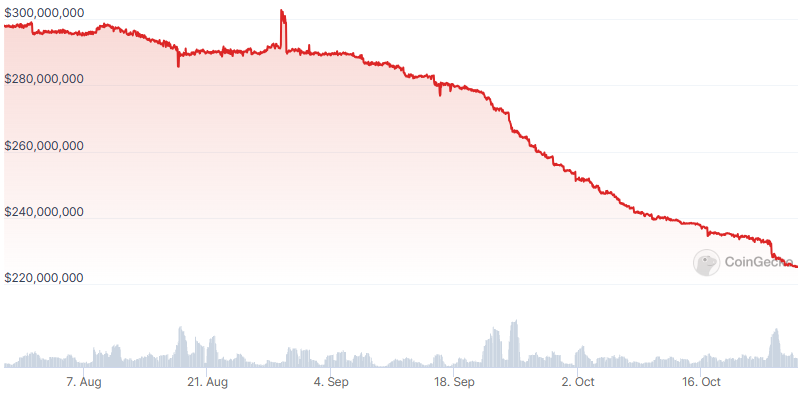

Liquity's LUSD stablecoin LUSD has seen a substantial drop in market capitalization as the rate of trove redemptions accelerates. Liquity troves are collateralized debt positions (CDPs) that enable users to borrow LUSD against their ETH deposits.

Redemptions occur when the price of LUSD drops below $1. Liquity's peg stability mechanism allows users to redeem 1 LUSD for $1 worth of ETH to maintain price stability. However, this ETH comes from troves with the lowest collateralization ratios.

On October 24th, over 4.13M LUSD tokens were redeemed for ETH. In the past month alone, the total supply of LUSD has dropped by almost 40 million tokens.

The rise in trove redemptions has prompted users to close their troves and seek alternative lending protocols. Some users have expressed frustration with Liquity's redemption mechanism, saying that it is not capital-efficient for borrowers and causing the biggest users to leave.

Currently, the recommended safe collateral level for troves is 240%, which means that one can safely borrow only around $42 in LUSD against $100 worth of ETH. As of this writing, troves with collateral levels as high as 221% have been redeemed, which is much higher than anticipated. Last month, the average collateral ratio of redeemed troves stood at 181%.

Arbitrage bots have been taking advantage of the ongoing arbitrage opportunity arising from MakerDAO’s DAI Savings Rate, exerting downward pressure on the price of LUSD and shrinking its supply.

Head of Strategy tokenbrice explained that the protocol is reaching a new equilibrium. As users pay off their debt and close their troves, the supply of LUSD decreases. However, this reduction in supply boosts the yield for LUSD stakers in the stability pool. Currently, the LUSD stability pool offers stakers an annual yield of 4.53% APR.

Read the original post on The Defiant

undefined