Cardano (ADA) is pulling back on Friday after hitting its highest level since April on Thursday near $0.41 per token.

ADA was last changing hands around $0.36, about 11% down versus weekly highs, but is still holding onto impressive gains of around 50% from the mid-October lows under $0.24.

Cardano has been pumping tandem with a broader rally across the crypto market, the main catalyst of which is largely agreed to be optimism about expected upcoming approvals of spot Bitcoin ETFs in the US, which should spur institutional adoption of cryptocurrencies more broadly.

Macro conditions have also taken a turn for the better this month, with US stocks pumping and US bond yields and the dollar dumping on bets the Fed will start cutting interest rates in mid-2024 as inflation and the economy slows.

As such, despite the recent pullback, dip buyers have been able to hold Cardano above its major moving averages in recent weeks, including its 21-Day Moving Average (DMA), which was last at $0.344.

With technical analysis suggesting a potential near-term pump to the north of $0.50, price predictions are likely to remain bullish.

Bullish Price Predictions – What’s Fuelling the Optimism?

A few key recent technical developments have fuelled optimism that Cardano could soon surpass $0.50.

Firstly, back in October, the cryptocurrency broke convincingly to the north of a downtrend that had been in play going all the way back to early 2022.

It then proceeded to decisively break above its 200DMA, often viewed as a sign that an asset classes’ near-term momentum has taken a substantial turn for the better.

Cardano is also likely to enjoy a bullish “golden cross” where its 50DMA crosses above its 200DMA.

A near-term test of 2023 highs at $0.46 seems likely, with a break above here opening the door to a sift move back to mid-2022 highs in the $0.50s.

Weak Network Activity Suggests Cardano Still a “Ghost” Chain

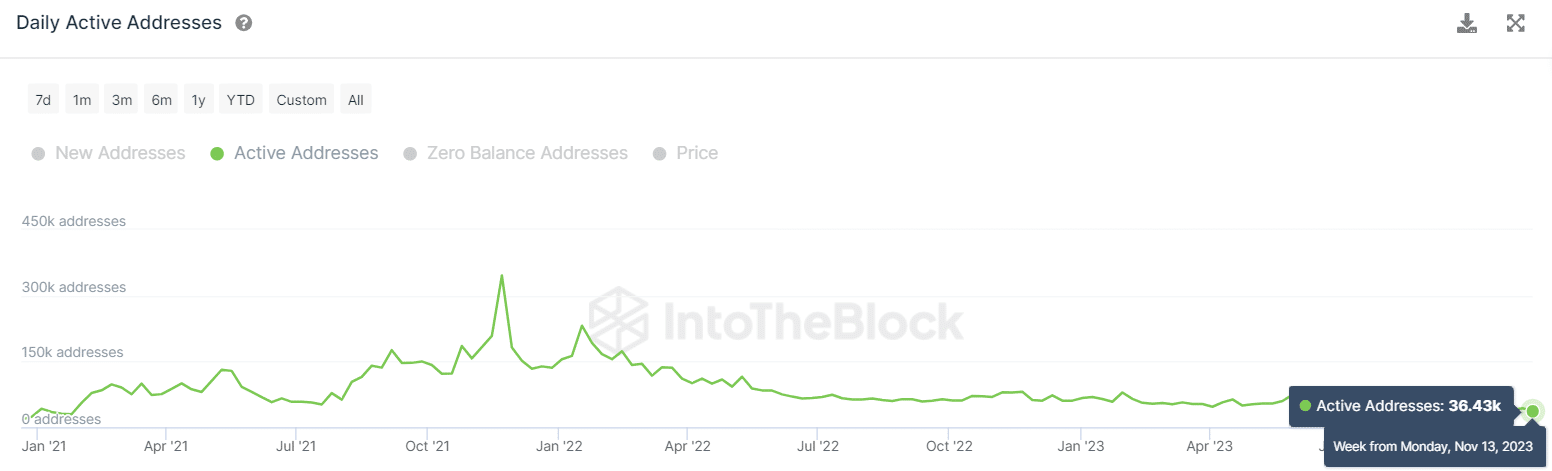

Whilst macro fundamentals and ADA technicals look good, weak on-chain activity remains a concern for the cryptocurrency, with Cardano very much still looking like a ghost chain that very few people are actually using.

As per data presented by IntoTheBlock, Daily Active Addresses on the network remain close to two-year lows at only around 36,000.

Meanwhile, growth in the number of Cardano wallet addresses with a non-zero balance has pretty much stagnated this year at 4.46 million, while the number of daily transactions remains stuck near yearly lows under 60,000 per day.

That pales in comparison to chains like Ethereum, Solana and Bitcoin.

While Cardano could do well, unless it gains more usage, it may lag some of its faster-growing peers in the maturing bull market.

Crypto Alternatives to Consider

Cardano could offer good returns but comes with a lot of risk.

Those looking for a better probability of near-term gains, an alternative high-risk, high-reward investment strategy to consider is getting involved in crypto presales.

This is where investors buy the tokens of upstart crypto projects to help fund their development.

These tokens are nearly always sold cheaply, and there is a long history of presales delivering huge exponential gains to early investors.

Many of these projects have fantastic teams behind them and a great vision to deliver a revolutionary crypto application/platform.

If an investor can identify such projects, the risk/reward of their presale investment is very good.

The team at Cryptonews spends a lot of time combing through presale projects to help investors out.

Here is a list of 15 of what the project deems as the best crypto presales of 2023.

The post Cardano Price Prediction: Technical Analysis Supports a Rise to $0.50 – What’s Fueling This Optimism? appeared first on Cryptonews.

#PricePredictions #ADA #Cardano #PricePrediction [Source: CryptoNews]