The ever-volatile cryptocurrency industry benefited from Donald Trump’s growing chances to win the US presidential elections with massive rallies by most assets.

Bitcoin finally broke its March all-time high of $73,737 and soared past $75,000 to chart a new peak. Its market capitalization exploded in tandem to a high of its own at $1.5 trillion at one point.

Although the metric has declined slightly since then, as BTC’s price has slipped to $74,500 now, it has still helped the cryptocurrency return to the top 10 global assets by market cap.

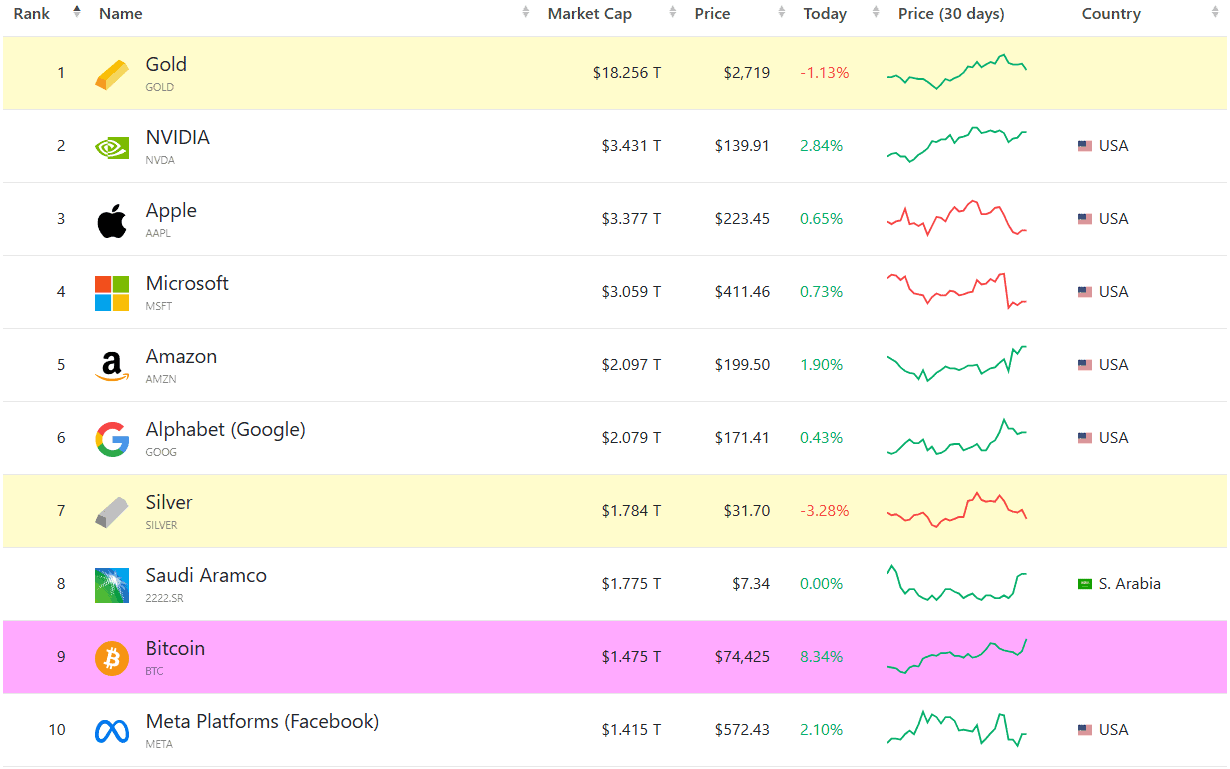

With its current number of $1.475 trillion, bitcoin stands at 9th spot, ahead of giants like Meta Platforms (10th), Berkshire Hathaway (12th), Tesla (14th), and Walmart (16th).

Gold is the absolute leader with a market cap of over $18 trillion, even though the metal’s price has actually retraced today by 1.1%. NVIDIA follows suit with $3.4 trillion. Next on the list are Apple ($3.377 trillion), Microsoft ($3.06 trillion), Amazon ($2.1 trillion), and Alphabet ($2.08 trillion).

BTC’s next targets are Saudi Aramco ($1.775 trillion) and silver ($1.784 trillion). The precious metal is also down today, by more than 3%.

The second-largest cryptocurrency by this metric, Ethereum (ETH), has gained around 7% of value in the past day. Its price tag of nearly $2,600 means that its market cap is at over $310 billion, placing it at the 34th place, behind the likes of Bank of America, Netflix, and Johnson & Johnson.

Those are the only two cryptocurrencies in the top 100 list of largest assets, according to CompaniesMarketCap.

The post Bitcoin Returns to Top 10 Biggest Global Assets by Market Cap After Soaring to $75K appeared first on CryptoPotato.

#AANews #BTCEUR #BTCGBP #BTCUSD #BTCUSDT #CryptoNews #Bitcoin(BTC)Price #Gold [Source: CryptoPotato]