The crypto exchange giant Binance is hoping to corner the Japanese market by expanding its crypto pairing offerings by 13.

The firm launched in Japan in August this year, following its acquisition of the Sakura Exchange BitCoin trading platform in November 2022.

Binance Japan has since begun migrating Sakura users to its platform.

Binance recently announced that it will no longer accept Japanese residents on its global site from December.

In a Binance Japan press release, the firm said that its goal was to list “100 tokens” on its platform.

This goal is not unambitious considering Japan’s notoriously strict token listings policy.

Coins must be approved by a self-regulating listings panel, with the regulatory Financial Services Agency having the final say on listing applications.

But in recent months, this process – which once took between six months and a year per coin – has been relaxed.

Tokyo has softened its stance on regulation as the government looks to foster its crypto sector and Web3 sectors.

Binance Japan CEO Chino Takeshi said that the platform now handles 47 coins.

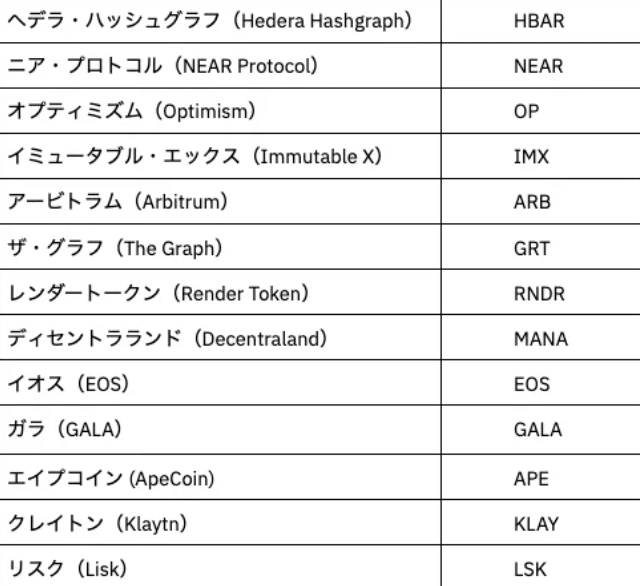

The list of newly added coins includes the Near Protocol (NEAR) token, EOS, Kakao’s KLAY coin, and Hedera Hashgraph (HBAR).

All coins have previously gained approval from the self-regulating Japan Virtual and Cryptoassets Exchange Association (JVCEA).

Japan: Can Binance Succeed Where Other Crypto Exchanges Have Failed?

Binance was forced to exit Japan in 2018 after Tokyo imposed some of the most restrictive crypto regulations in the world.

The regulations forced all but a small handful of domestic startups out of the market.

Previous attempts from the likes of FTX and Coinbase to break into the Japanese market have ended in failure.

But Chino struck an optimistic note, explaining:

“We will further expand our services in Japan and play a leading role in the spread of cryptoassets in Japan. Please look forward to the future of Binance Japan.”

The post Binance Japan Adds 13 New Crypto Pairs appeared first on Cryptonews.

#BlockchainNews #News #Binance #Japan [Source: CryptoNews]