Key takeaways:

- Meme coins dominated the crypto narrative in Q2, driving DEX volume increase to $371 billion.

- Solana and Base meme coins, along with celebrity endorsements, pushed this trend.

- However, the rapid growth raises concerns about whether this can last and if the market is getting too crowded. It’s also uncertain if these tokens can keep up the hype in Q3.

- Decentralized exchanges continue to gain traction as centralized exchanges face regulatory hurdles.

Meme coins have brought the most attention to cryptocurrency since NFTs popularized decentralization during the pandemic. According to a recent CoinGecko report, meme coins, together with real-world assets (RWA)—tangible assets that can be tokenized on the blockchain—and AI, accounted for 36% of the crypto narrative market share during the second quarter (Q2).

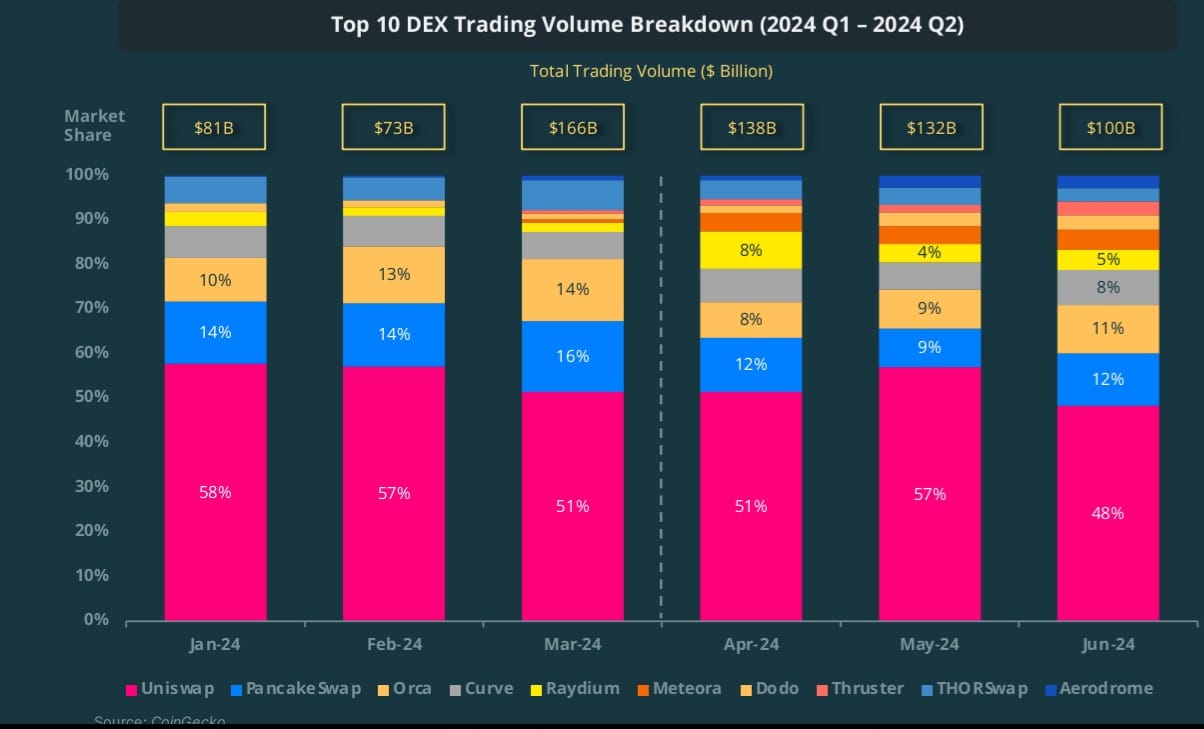

The report said meme coins alone made up four of the 15 most popular cryptocurrency narratives, driving spot trading volume on decentralized exchanges (DEXs) up 16% from the previous quarter. Between April and June, the top 10 DEXs traded the equivalent of $371 billion in cryptocurrency, with Solana DEXs—the lynchpin of the meme coins sub-culture—rising the most.

Meanwhile, spot trading volume on leading centralized exchanges (CEXs) fell 12% quarter-on-quarter to $3.4 trillion, dragged by increased regulatory scrutiny and the poor performance of venture capital-backed tokens, among other issues. Volume slumped on Binance, the world’s biggest exchange, but Bybit became the second-largest spot CEX, accounting for nearly 13% of the total trading volume in Q2.

However, the quick rise of meme coins seen in the second quarter might not continue, analysts suggest. They point to several reasons, including a shift in investor sentiment, changing market conditions, and declining hype. Indeed, CoinMarketCap reports that meme coin traffic dropped from 23% of total web traffic in the second quarter to 15% in the first two weeks of July.

“Investors may shift towards projects with stronger fundamentals, especially in an economically uncertain market environment,” Ryan Lee, chief analyst at Bitget Research, told Cryptonews. “As the crypto market matures, people increasingly prefer projects with clear use cases, utility, and strong development teams,” he added.

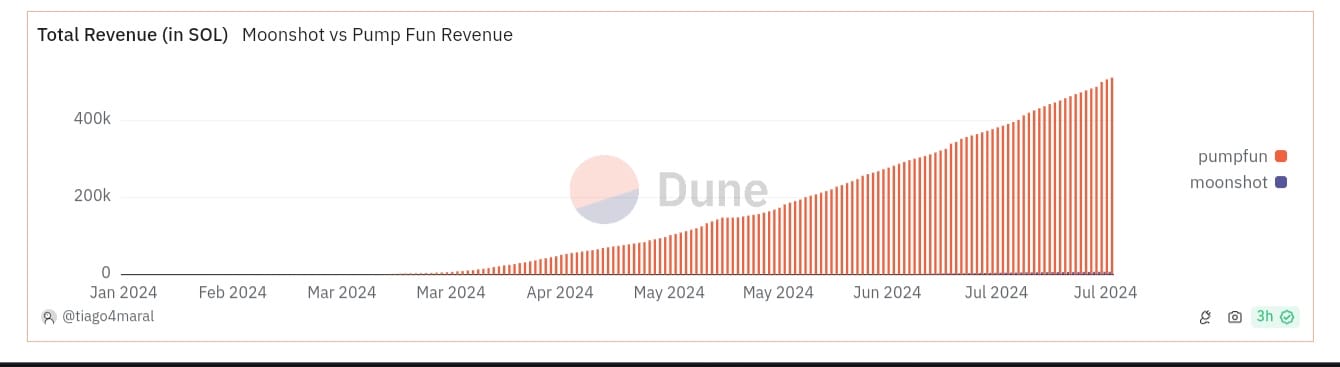

Meme coins typically attract investors through viral marketing and social media hype. But this can also lead to market saturation, Lee says, making it difficult for new meme coins to stand out. In Q2, the most popular meme coins were those launched on the Solana blockchain and Coinbase’s Base. For example, over 1.2 million tokens were released on the Solana-based launchpad Pump.fun, generating $48 million in revenue.

As of July 30, Pump.fun has generated more than 506,000 SOL in revenue, worth around $93 million, according to Dune Analytics. For the quarter in review, cat-themed meme coins like Shark Cat performed well, as did celebrity-backed meme coins such as Caitlyn Jenner’s JENNER, rapper Iggy Azalea’s MOTHER, and DADDY, which is backed by the controversial social influencer Andrew Tate.

Meme Coin Hype Could Die in Q3

Because meme coins rely on social media trends rather than fundamental value, it’s not surprising that many can quickly become worthless once the initial excitement wears off. In 2023, BALD, a meme coin on Base that made fun of Coinbase CEO Brian Armstrong, crashed to zero one day after its launch. The token initially skyrocketed by 3,000% before the developers withdrew over $26 million in liquidity and vanished.

That’s just one of many risks associated with trading meme coins. Another risk is that the tokens are purely speculative. Apart from a few dominant ones like DOGE, Pepe, Floki, and Shiba Inu, which have all reached over $1 billion market capitalization, most meme coins simply don’t have the staying power. As Cryptonews recently reported, meme coins’ narrative dominance during Q2 is starting to decline, and celebrity tokens on Solana are fading.

This will have major implications for meme coins during the current quarter. Lee, the Bitget analyst, attributed the trend to the speculative nature of the tokens – something that could lead to a reassessment of risk and a reduction in similar investments. “The trend of declining popularity for meme coins may continue, particularly if broader market conditions remain uncertain or bearish,” he noted, adding:

“It could result in decreased trading volumes and stagnant prices for many meme coins. We might [also] see consolidation in the meme coin market, with only projects having strong community support and unique features surviving, while others gradually disappear.”

On the positive side, emerging trends such as celebrity endorsements or integration with popular culture could lead to a resurgence in meme coins, Lee adds. For example, on July 8, the Solana meme coin Water rose as much as 350% after football star Lionel Messi’s Instagram account posted a picture promoting the token to his 504 million followers.

The first time ever Messi is promoting a Memecoin via Instagram $WATER , IS THAT MESSIS MEMECOIN?! pic.twitter.com/h0SxKTCrqq

— WALL STREET BINANCE (@Wallstreet_bnb) July 8, 2024

Water’s presale was oversubscribed, and the token hit $500 million in market cap. However, it has struggled to keep its head above water ever since. The price of Water has slumped more than 95% since a high of around $0.00264 on June 26, per CoinGecko data. The plunge suggests that without real utility, even celebrity backing might not be enough to save some meme coins.

Meme tokens could also benefit from the recent Bitcoin halving event. It occurs every four years and reduces the amount of Bitcoin (BTC) that goes into circulation. Halving tends to boost the price of BTC and has previously led to stronger interest in other crypto assets that are not Bitcoin, including meme coins. The price of Bitcoin climbed over 85% to an all-time high of $73,000 in the period leading up to the halving event in April 2024, lifting the rest of the market with it. As traders look for opportunities outside of Bitcoin, meme coins could see further growth as they capture the speculative interest of investors looking for the next big trend, according to analysts.

Decentralization Is the Basis of Crypto

The contrast between decentralized and centralized exchanges represents a core debate in cryptocurrency. Decentralized exchanges (DEXs) allow users to trade directly with each other without a central authority, a function that arguably counts as crypto’s most disruptive.

As legal challenges and regulations tighten around centralized financial platforms, decentralized trading is regaining popularity. Some high-profile legal issues, like those faced by Binance in Nigeria and the U.S. have pushed some in the crypto community underground. As a crypto-focused lawyer notes in an op-ed, the rise of P2P and DEX trading could very well fulfill Satoshi Nakamoto’s original vision for cryptocurrency.

Felix Sim, co-founder and CEO of Singapore-based web3 platform Salad Ventures, told Cryptonews that the drop in CEX trading volumes and the rise in DEX activity indicates a profound change in investor preferences.

“This shift is driven by increased regulatory scrutiny on centralized platforms, prompting investors to seek decentralized alternatives that offer greater privacy and control,” Sim said. “Advancements in DeFi protocols and layer-2 scaling solutions, which enhance transaction speeds and reduce costs, are making DEXs more attractive and accessible,” he added.

On the other hand, the exposure of decentralized exchanges to meme coins—primarily native to Solana—and previously to NFTs—primarily native to Ethereum—brings usual assumptions about decentralized finance (DeFi) into question. DeFi is often seen as crypto’s underground since there are no centralized exchanges to handle security and interoperability.

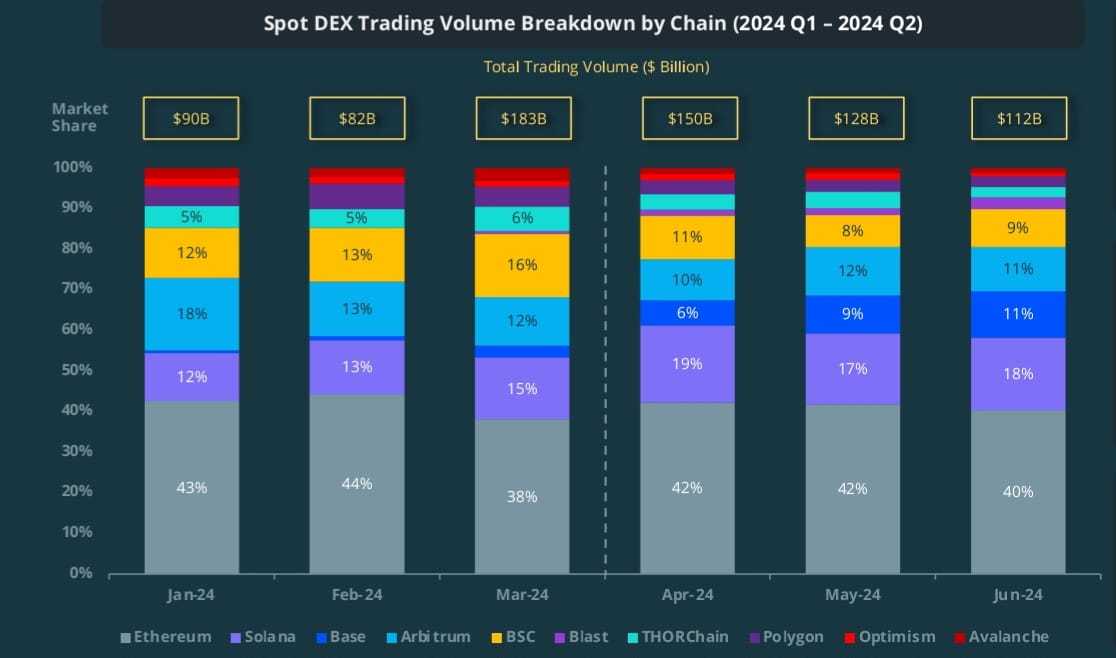

With meme coins and non-fungible tokens, decentralization has given the crypto industry its most popular narratives and broadened the appeal for the uninitiated. According to CoinGecko’s second quarter report, the 22% crypto narrative share of Solana and Base blockchains, which are both exposed to meme coins, is proportional to the rising DEX activity.

Decentralized exchange trading volume on Ethereum, the second-largest cryptocurrency after Bitcoin, rose 12.5% quarter-over-quarter to $162.5 billion, accounting for 40% of the total spot DEX transaction volume. Solana ended the June quarter with a trading volume of $20 billion and 18% of the market share. Base emerged as the largest layer 2 ecosystem.

DEXs such as Orca, Raydium, and Aerodrome owed their Q2 surge to novelty tokens and new projects that issued airdrops—a type of free cryptocurrency giveaway that is “dropped” into people’s wallet addresses. Meanwhile, Uniswap remained the top decentralized exchange, holding a 48% market share.

CEXs Still ‘Necessary and Irreplaceable’

In contrast to the meme coin buzz, venture capital-backed digital currencies, which were a mainstay of centralized exchanges, appear to have been on the decline in recent months. Quarterly investments by VCs in crypto projects have slumped from $12 billion during the first quarter of 2022 to between $2-$3 billion in the past two quarters.

Bitget Research’s Ryan Lee cited the downward trend as one of the reasons CEXs are trading negatively while decentralized exchanges are on the rise.

“The poor performance of VC coins and their increasingly negative reputation on social media have significantly reduced the trading volume of these tokens on centralized exchanges,” Lee said. “Whether this trend will continue in Q3 is hard to predict, as it is closely related to the overall market trend and whether there will be a ‘meme season. ”

Beyond novel propositions, the analyst maintains that CEXs remain “absolutely necessary and irreplaceable.” He pointed to things like user-friendliness and support for different fiat solutions to people in various countries as a key selling point for centralized exchanges. In most instances, DEXs do not directly support fiat trading, “which is a barrier for new users and a critical need that cannot be ignored,” Lee said.

“Centralized exchanges provide more financial services,” he averred. “They offer various asset management and strategy trading services, with multiple financial products available for holding BTC, ETH, or other altcoins. Copy trading and strategy trading on CEXs are also more mature and secure.”

The post The End of Meme Coins? Experts Say the Mania Is Dying Out appeared first on Cryptonews.

#AltcoinNews #Features #CEXs #DEX #Memecoin [Source: CryptoNews]