The US Securities and Exchange Commission (SEC) remains unyielding amidst escalating interest in a Bitcoin spot exchange-traded fund (ETF), and Ark Invest’s Cathie Wood believes she may have identified the reason.

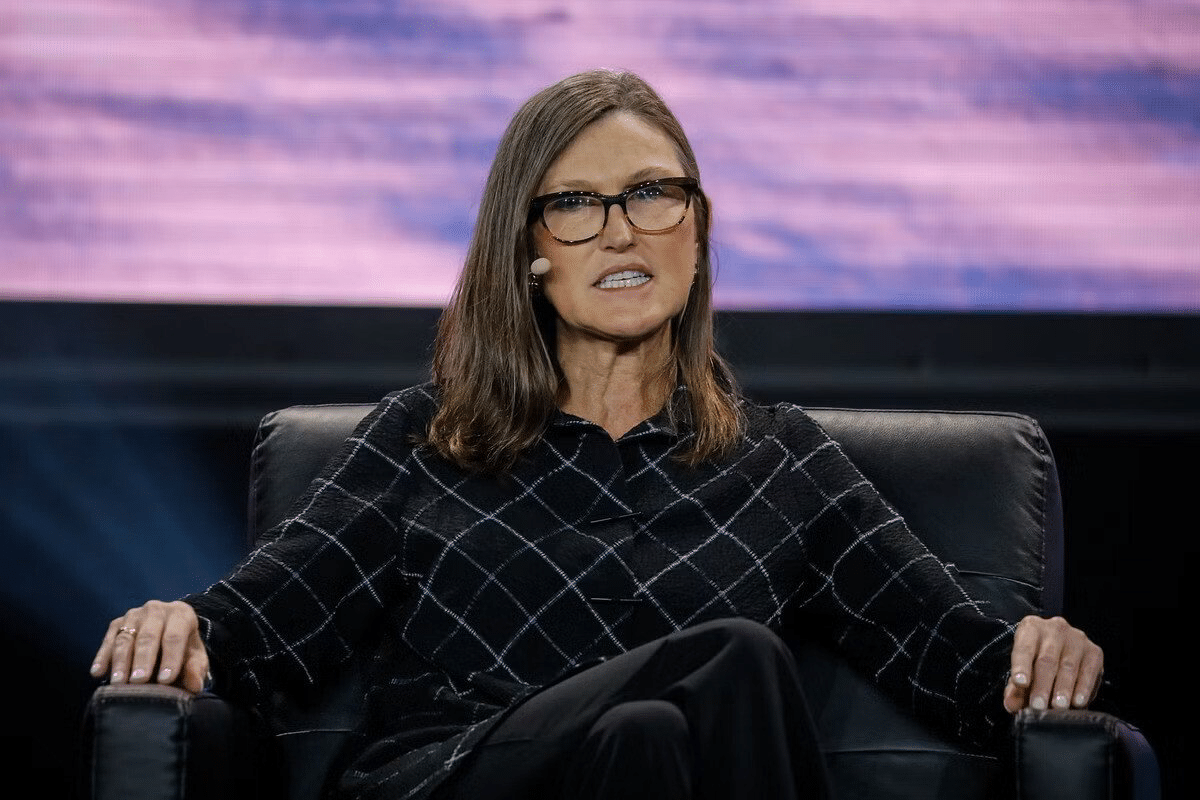

Making a special appearance on CNBC’s Squawk Box earlier today, the veteran investor and founder of one of the largest US asset management firms said the SEC boss’ political dreams might be a huge hindrance in the approval of a Bitcoin spot ETF.

CATHIE WOOD: Gensler's reluctance toward a spot #Bitcoin ETF stems from his fear of manipulation, despite teaching about #Bitcoin at MIT

Speculation suggests his aspirations to be Secretary of the Treasury might be the actual reason for the approval delay

pic.twitter.com/tSSDIz4Ku0

— Bitcoin News (@BitcoinNewsCom) November 14, 2023

According to Wood, there is growing “speculation” surrounding Gensler’s intent to become the Treasury Secretary. Given this, a Bitcoin spot ETF could further complicate his aspirations.

“What does the Treasury Secretary do? It’s very focused on the dollar,” she added.

Wood’s speculations come from the fact that Gary Gensler comes from a rich crypto background.

Before taking over the reins of the top US regulatory agency, Gensler was a crypto and blockchain professor attached to the Massachusetts Institute of Technology (MIT).

Wood contends that his deep industry knowledge contradicts his refusal to approve a Bitcoin spot ETF during his two-year tenure.

Gensler has cited market manipulation of cryptocurrencies like Bitcoin as one of the plethora of reasons behind the government agency’s reluctance. However, Wood disputes this.

According to her, Bitcoin is a decentralized and transparent network, and all transactions can easily be traced on it, making it highly improbable that market manipulation will be successfully executed.

Running on distributed ledger technology (DLT), cryptocurrencies like Bitcoin are known to be publicly viewable. They are also immutable, making it hard for transactions to be modified once approved by a group of distributed miners.

Crypto Market Could Hit $25 Trillion in Market Valuation

Wood’s Ark Invest has been one of the staunch supporters of crypto native services hitting the mainstream financial markets in the last couple of years.

The firm also filed a Bitcoin spot ETF interest with the SEC in hopes of getting approval from the top US agency.

Joining Ark Invest in this pursuit is the $11 trillion asset under management (AUM) firm BlackRock, which is becoming increasingly confident that a Bitcoin spot ETF approval could be made as early as January 2024.

Scoop: @BlackRock growing increasingly confident @SECGov will approve its BTC ETF by January, sources tell @FoxBusiness more now w @LizClaman

— Charles Gasparino (@CGasparino) November 9, 2023

Other major players, including Fidelity, Grayscale, WisdomTree, and others, are also seeking approval from the SEC.

Wood believes this collective interest in the top cryptocurrency could spur a significant uptrend in Bitcoin’s price and the broader crypto market.

Making her projections for the next seven years, Wood stated that the crypto market can transcend its $1 current market valuation and hit $25 trillion by 2030.

She states that a Bitcoin spot ETF approval could easily lead to an influx of liquidity from several mainstream investors who have largely remained on the sidelines due to a lack of regulatory clarity from the US government.

The post Cathie Wood Speculates SEC Chair’s Political Aspirations Are Hindrances Towards Judgment Call on Bitcoin Spot ETF appeared first on Cryptonews.

#BlockchainNews [Source: CryptoNews]