[TheDefiant]

The team behind one of crypto’s oldest projects has elected for a hard reset.

The Aragon Association (AA), the legal entity which oversees the project and the Aragon DAO, is shutting down. As part of the process, the project’s ANT tokens can be redeemed for 86,343 ETH, worth over $115M at the time of writing. This accounts for 87% of the treasury’s non-native assets.

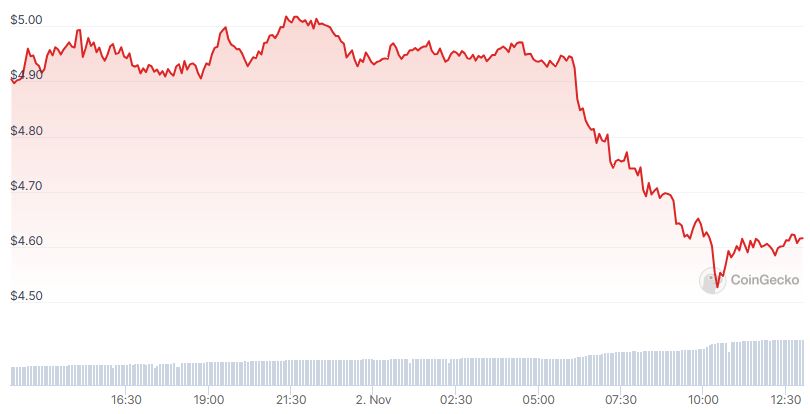

The rate of exchange is fixed at 0.0025376 ETH per ANT token – currently worth $4.56 – and the redemption window is open for a year. ANT dropped 6% to $4.60 on the news and is trading roughly in line with the redemption value.

Aragon provides tooling for decentralized organizations (DAOs) and launched in 2016 after raising roughly $25M worth of ETH in the ANT token sale. Heavyweights like Lido Finance, DeFi’s largest project by TVL, use Aragon’s tooling to run their DAOs.

Aragon’s treasury made headlines in May as an opportunistic group of investors bought up ANT tokens, which have vastly underperformed against the ETH held in the project’s treasury since peaking in December 2021. The idea was to use the ANT to vote to redeem the tokens for ETH, a potentially profitable move that AA controversially nixed.

Now, the AA is allowing the redemptions to proceed.

There is an irony to Aragon’s struggles. The project’s founders designed Aragon to revolutionize how organizations ran, but in the end, encountered some of the same struggles that it aimed to help other operations to overcome.

Aragon is not shutting down, however. A new entity called the Product Council will take control of Aragon’s IP, infrastructure, and “operational runway.”

“For builders and developers, this changes nothing,” Aragon said. “The Aragon Project will continue its mission by doubling down on building resilient onchain governance tooling and infrastructure.”

The council is seeking members. Interested parties should be builders of Ethereum infrastructure and have experience with Aragon products.

Aragon has had rocky moments in the past — a wave of resignations hit the project in 2021 under murky circumstances.

Read the original post on The Defiant

undefined