[TheDefiant]

Uniswap, the largest decentralized exchange by trade volume, announced it will start charging a swap fee for a select group of tokens on its web app and wallet.

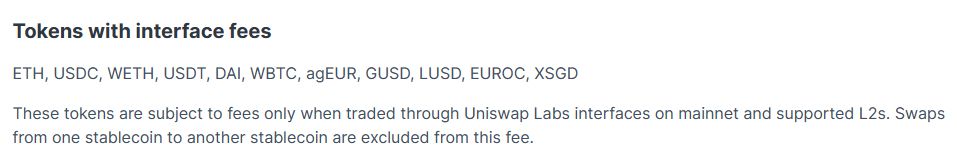

Starting tomorrow, Uniswap Labs will implement a 0.15% swap fee on certain trades made through its frontend, the company said in a post. The fee will be applied to tokens driving the most trading volume on the DEX, including ETH, USDC, WETH, USDT and DAI. Both the input and output token need to be on the list for the fee to apply.

This initiative is distinct from the Uniswap Protocol fee switch, which is determined by the UNI token governance voting process.

Uniswap Labs is the company that builds products on top of the Uniswap protocol.

Uniswap Labs Business Model

According to founder Hayden Adams, the company aims to create a transparent and sustainable business model that strengthens Uniswap's capacity to research, develop, and promote the expansion of crypto and DeFi solutions.

The move doesn't do much for UNI holders, who have been waiting for the near-mythical fee switch to be turned on for years. Ethereum investor Eric Conner says it will add value to Uniswap equity while leaving tokenholders out in the cold.

"No idea why anyone holds UNI. *This* is the kind of token the SEC should be cracking down on, not the ones that actually do have intrinsic system fees," said Gabriel Shapiro, general counsel at Delphi Labs.

Still, others argued a sustainable business model for Uniswap Labs would ultimately boost all of the Uniswap ecosystem.

"Smart move! A sustainable path for Uniswap Labs is a big positive for crypto," said Farcaster co-founder Dan Romero.

As the bear market has dragged on, Uniswap has continued to ship new products, releasing an iOS wallet, Android wallet, UniswapX, significant enhancements to their web app, Permit2, and the draft codebase of Uniswap v4.

Uniswap is DeFi's fourth-largest protocol with just over $3B in total value locked, which peaked above $10B in April 2021 coinciding with the launch of Uniswap V3.

Read the original post on The Defiant

undefined