[TheDefiant]

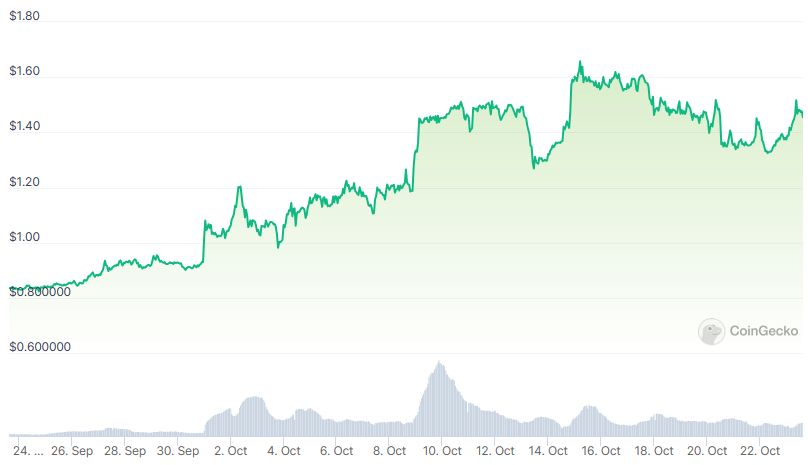

Liquity, a decentralized lending protocol, has seen its utility token, LQTY, surge by over 75% in the past 30 days despite a sluggish market, which can be largely attributed to an arbitrage opportunity stemming from MakerDAO's DAI Savings Rate (DSR).

MakerDAO offers a 5% APR on DAI deposits. Traders have been taking advantage of this by minting Liquity's LUSD stablecoin against ETH by paying a one-time borrowing fee of 0.5% and subsequently selling LUSD for DAI, which is then deposited into the DSR module.

As traders sell LUSD, pushing it below its $1 peg, arbitrage bots step in to purchase the discounted LUSD and use it to redeem $1 worth of ETH from the Liquity protocol. This maintains LUSD's dollar peg.

Over the past month, more than $625,000 has been distributed to LQTY stakers, who receive all the borrowing and redemption fees generated by the protocol, a Liquity spokesperson told The Defiant.

img,[object Object]

In its upcoming V2 iteration, Liquity aims to scale up in a bid to solve the stablecoin trilemma – combining stability, capital efficiency, and decentralization.

The team plans to introduce two new features – principal protection and a secondary market. Principal protection allows users to hedge their risk during market volatility by paying a premium for opening hedging positions, which can be sold for the principal amount.

The secondary market enables users to buy and sell their hedging positions, reducing the risk of a bank run on the system. If a position remains unsold within a specified timeframe, the protocol utilizes the collected premium to subsidize and attract potential buyers.

Liquity V2 is expected to launch in Q2 2024.

Read the original post on The Defiant

undefined